Benchmarking the Rent of Your Premises

- Home

- Articles

- Business Benchmarks

- Benchmarking the Rent of Your Premises

Managing overheads is a key factor in maintaining profitability, particularly for small and medium enterprises (SMEs). One of the largest overheads can often be the cost of the business premises. Whether you’re operating a retail store, an office, or a workshop, the rent you pay has a direct impact on your bottom line. This guide aims to walk you through the process of rent benchmarking, illustrating its importance, how to calculate and compare it to industry standards, and strategies for effective rent management.

The article covers:

What is Rent Benchmarking?

Rent benchmarking is the process of comparing the cost of your business premises with similar properties in the market. This comparison can be done two ways. First, business owners can research other properties within the same geographic area, industry, or business size. It involves gathering data on rental costs and assessing how your own rent compares to the average or standard in your sector or region.

However, a more accurate benchmark is assessing the percentage of revenue a business spends on rent; and comparing this against similar businesses. This method provides a true reflection of the cost of rent in comparison to competitors and other business expenses.

Importance of Rent Benchmarking

Why Benchmark Rent?

The primary aim of rent benchmarking is to ensure that the rent you are paying is competitive and reasonable, given market conditions. It helps business owners understand if they are overpaying, getting a good deal, or if their rent is aligned with the industry average.

Further, rent benchmarking is an essential part of financial management for several reasons:

➤ Budget Management and Planning: Benchmarking rent helps in creating a more accurate and effective budget, allowing for better allocation of resources.

➤ Profitability and Cost Control: Rent is a significant recurring expense. Ensuring it aligns with industry averages helps in maintaining profitability.

➤ Informed Decision-Making: Understanding your rent in the context of the market can guide decisions related to business expansion, downsizing, or relocation.

➤ Operational Efficiency: High rent costs can force businesses to cut corners elsewhere, impacting the overall efficiency of operations.

➤ Customer Experience: The location and quality of premises, often dictated by rental costs, play a significant role in customer perception and experience.

➤ Adapting to New Work Norms: Understanding rent in the context of hybrid, remote, or flexible work arrangements is increasingly important.

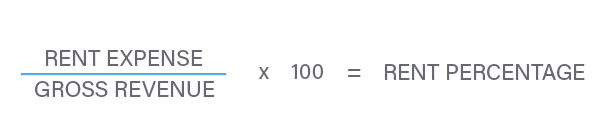

Calculating Rent as a Percentage of Revenue

A simple yet effective way to understand the impact of rent on your business is by calculating it as a percentage of your revenue:

Formula:

Definition

Rent Expense: Total annual rent, inclusive of any ancillary costs.

Gross Revenue: Annual revenue before deducting any expenses.

Key Considerations: Factor in seasonal business variations and any expected changes in rent or revenue.

Example Calculation

For instance, if your annual rent is $50,000 and your gross revenue is $500,000, your rent as a percentage of revenue is 10%.

Comparing Rent to Industry Benchmarks

Rent benchmarking can offers significant insights for business owners. Understanding how your rent stacks up against industry benchmarks can guide you in making informed decisions about your business premises. Here’s a deeper look at some of the advantages:

➤ Understanding Competitive Position

⚈ Assess Your Position: By comparing your rent to industry benchmarks, you can determine if you’re paying more or less than similar businesses in your area or sector. This knowledge is crucial for assessing the competitiveness of your business.

⚈ Market Alignment: It helps you understand whether your business costs are aligned with market expectations, which is vital for maintaining a competitive edge.

➤ Identifying Cost-Saving Opportunities

⚈ Negotiation Leverage: If you find that your rent is above the industry average, this information can be used as leverage in rent negotiations with landlords.

⚈ Strategic Relocation: Understanding how your rent compares may lead you to consider relocating to a more cost-effective area, thereby reducing overhead costs.

⚈ Budget Reallocation: Savings on rent can free up budget for other areas of your business, such as marketing, staff training, or technology upgrades.

➤ Aiding in Financial Planning

⚈ Accurate Budgeting: Comparing your rent to industry benchmarks helps in creating more accurate financial plans and budgets, ensuring that your business resources are allocated efficiently.

⚈ Forecasting and Growth Planning: This practice assists in forecasting future costs and revenues, which is essential for long-term business planning and growth strategies.

Practical Strategies for Optimising Rental Costs

To manage your rental expenses effectively, consider these strategies:

1. Lease Negotiations Regularly review and negotiate your lease terms. Factors like lease duration, rent increases, and break clauses can significantly impact your costs.

2. Exploring Alternative Spaces Consider shared or co-working spaces, which can offer more flexible and cost-effective solutions.

3. Location Versus Cost Evaluate whether your current location justifies its cost. Sometimes, relocating to a less expensive area can reduce costs without significantly impacting business.

4. Subleasing Unused Space If you have surplus space, consider subleasing it to offset your own.

5. Flexible Working Arrangements Implementing hybrid or remote work policies can reduce the need for large office spaces, thereby lowering rent expenses.

6. Four-Day Work Weeks This emerging trend can lead to shared office arrangements, allowing for more efficient use of space and rent savings.

Conclusion

Rent benchmarking is vital in today’s evolving business environment. Understanding and effectively managing your rent, especially in the context of new working norms like hybrid and remote work, is not just about cost-cutting but about strategic financial management. It ensures that your business remains adaptable, efficient, and competitive.