Net Profit Margin – Business Benchmark

- Home

- Articles

- Business Benchmarks

- Net Profit Margin – Business Benchmark

Net profit margin is the percentage of net profit earned in relation to total revenue, indicating how efficiently a company generates profit from its sales.

Net profit margin is different from the net profit, but both are crucial financial metrics that reveal a company’s profitability.

Whilst net profit signifies the income retained after deducting expenses, net profit margin is expressed as a percentage. This demonstrates how effectively a company generates profit from sales.

A higher net profit margin suggests better cost control and greater returns. For instance, a company with $200,000 net profit and $1 million revenue has a 20% net profit margin, indicating that 20 cents are retained as profit for every dollar earned.

Jump ahead to read:

1. Why is net profit margin an important business measurement?

While revenue is important, it is the net profit that determines a company’s financial health and sustainability. This is particularly true for small businesses where the net profit if often tied to the owners’ earnings and the total business value. Below highlights 5 reasons it’s important for business owners to measure net profit margins:

- Accurate Measurement of Business Performance

As the net profit considers all revenue earned and deducts all costs incurred, this reflects the business’s efficiency. Calculating the net profit margin helps evaluate the effectiveness of the business model and operational efficiency. A healthy net profit margin indicates the ability to cover expenses and generate surplus income for growth.

- Sustainable Growth and Investment Opportunities

Small businesses with consistent net profit have a better chance of sustainable growth. Positive net profit signifies the ability to reinvest in the business, expand operations, invest in research and development, and pursue marketing efforts. It acts as a financial cushion during challenges and attracts investors and lenders who view it as an indicator of growth potential and stability.

- Enhancing Business Valuation

Net profit plays a crucial role in determining the value of a small business during mergers, acquisitions, or seeking funding. A strong net profit track record enhances the perceived value, allowing owners to negotiate better deals and attract higher investments. It demonstrates a sustainable and profitable business model which business owners can leverage in the event of a sale or merger.

- Risk Mitigation and Financial Stability

Maintaining a healthy net profit ensures financial stability for small businesses facing uncertainties and risks. It provides a buffer against economic downturns, market fluctuations, and unexpected expenses. Building reserves and retaining profits helps mitigate risks, sustain operations, and reduce dependence on external funding sources. - Rewarding Stakeholders and Business Owners

Net profit rewards business owners and stakeholders who invest time, money, and resources. It allows entrepreneurs to reap the benefits of their efforts, compensate employees fairly, and reinvest in the business. Distributing dividends, offering bonuses, and investing in employee development programs foster a positive work environment, contributing to growth and success.

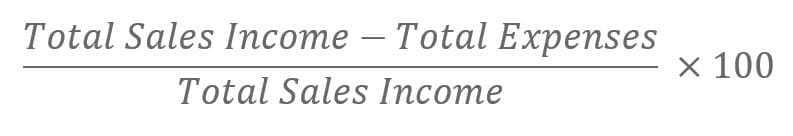

2. How do you calculate net profit margin?

Net profit margin is calculated by dividing the net profit of a business by its total revenue/income. As the net profit is total income minus total expenses, the calculation for net profit margin is:

However, net profit is often calculated before tax, interest and depreciation, which is commonly called EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). Therefore, business owners should be cautious when using net profit and net profit margins when planning cash flow as they need to consider tax implications.

Further, for many small businesses, the owners wage is often taken from the net profit. If this is the case for your business (or your client’s business), this calculation should be done before the owners wage and after the owners wage to ensure a true reflection of performance.

3. Why should a business compare net profit margins to competitors?

Comparing net profit margins with competitors is a valuable practice for small businesses aiming to thrive in a competitive market. The key advantages of benchmarking net profit margins against industry peers include:

- Understanding Market Position

Comparing net profit margins with competitors provides insights into a small business’s market position. Higher net profit margins indicate a competitive advantage and superior operational efficiency, while lower margins may necessitate cost-cutting or revenue enhancement measures to catch up. Understanding where a business stands relative to its competitors helps identify strengths and weaknesses.

- Identifying Operational Inefficiencies

Analysing net profit margins reveals potential operational inefficiencies. If competitors achieve higher margins, it suggests they may have better cost control, supplier negotiations, or resource optimisation. By examining these differences, small businesses can identify areas for improvement, streamline processes, and enhance profitability.

- Setting Realistic Goals

Benchmarking net profit margins helps small businesses establish realistic growth goals. By studying successful competitors’ margins, businesses can set ambitious yet achievable targets for increasing profitability, fostering a culture of continuous improvement.

- Uncovering Best Practices

Comparing net profit margins reveals best practices and innovative strategies of successful competitors. By learning from their approaches to cost management, revenue generation, and customer retention, small businesses can adapt and implement similar practices to drive growth.

- Gaining Investor and Lender Confidence

Benchmarking net profit margins enhances investor and lender confidence. Demonstrating a competitive net profit margin showcases financial viability and growth potential, attracting potential partnerships, funding, and favourable terms for expansion.

Benchmarking net profit margins against competitors equips small businesses with valuable insights, fosters improvement, and attracts stakeholders. It is a powerful strategy for staying competitive and achieving long-term success.

4. What can I do to improve net profit margin results?

For small businesses in Australia, increasing net profit margins is essential for sustainable growth and financial success. Business owners can improve their net profit margins by:

- Analysing Expenses and Improving Cost Controls

Thoroughly analysing expenses is vital for identifying areas where costs can be minimised without compromising quality. Review operational costs, negotiate with suppliers, optimise inventory management, and implement energy-saving measures. Emphasise cost-consciousness throughout the organisation and encourage employees to contribute ideas for cost reduction. Regularly monitoring and controlling costs can have a significant impact on net profit margins.

- Optimising Pricing Strategies

Review pricing structures to ensure they align with market demand and competitor offerings. Assess value-added services that can be bundled with products or services to justify premium pricing. Conduct market research to understand customer preferences and willingness to pay. Consider implementing dynamic pricing strategies or introducing tiered pricing options to capture different segments of the market. Pricing optimisation can directly impact profitability.

- Increasing Operational Efficiency

Streamline processes, eliminate bottlenecks, and invest in technologies that enhance productivity. Automation, cloud-based systems, and digital tools can reduce manual work, improve accuracy, and save time. Optimise supply chain and logistics to reduce costs and improve order fulfilment. Enhance employee training and skills development to ensure maximum efficiency. Focusing on operational excellence can drive down costs and improve net profit margins.

- Enhancing Customer Retention and Upselling

Acquiring new customers can be more expensive than retaining existing ones. Implement customer retention strategies such as loyalty programs, personalised experiences, and exceptional customer service. Upselling and cross-selling opportunities can increase the average transaction value. Strengthen customer relationships through effective communication, regular feedback collection, and addressing their pain points. Satisfied and loyal customers contribute to long-term profitability.

- Expanding into New Markets or Offer New Products/Services

Explore opportunities to diversify and expand the customer base. Assess the feasibility of entering new markets, both domestically and internationally. Identify gaps in the market and introduce complementary products or services. Conduct market research and develop a clear marketing and sales strategy to successfully penetrate new markets. Expanding the business’s reach can open up new revenue streams and increase net profit margins.

As each business is unique, the best way to improve net profit margins is to start with a business analysis. With the Benchmarking Suite, you can run unlimited analysis for your clients.