What is a competitor analysis and how do you create one?

- Home

- Articles

- Business Analysis

- What is a competitor analysis and how do you create one?

What is a competitor analysis?

A competitor analysis is a piece of research designed to compare your business (or your client’s business) against competitors. By researching both direct and indirect competitors, business owners can evaluate how their business is performing against peers and identify potential growth opportunities.

This research is often included in a marketing strategy, but should also be considered for strategic business plans, information memorandums, and business proposals.

The structure of a competitor analysis can vary pending on the industry and size of the business. The structure outlined in the article is designed for small to medium businesses. It can also be used for new business plans.

Continue reading to learn how to do a competitor analysis, or jump to your preferred section below:

- Find The Market Gaps

- Create A Unique Selling Point

- Identify Growth Trends

- Discover Strengths & Weaknesses

- Build An Achievable Business Strategy

- Prepare A Winning Information Memorandum

- Researching Direct Competitors

- Analysing Industry Competitors

- Analysing Indirect Competitors

- What To Do With The Results Of A Competitor Analysis

What are the benefits of a competitor analysis?

Understanding the competitive environment supports business owners to make strategic decisions. It can shape product development, pricing strategy, business growth opportunities, investment decisions and support owners create a unique selling point. We have highlighted the top benefits below for small to medium businesses.

Find The Market Gap/s

An important component of the competitor analysis is reviewing what the market need/problem is and what competitors offer as a solution. The market need can be a great place to start the competitor analysis. This can be done by determining what the ‘problem’ is and then researching how others solve it. It can also be achieved easily via desktop research (aka googling!).

From here, business owners can determine if there are any gaps in the market and develop products and services to fill them.

Create A Unique Selling Point

Unique Selling Points/Proposition (USP) tell customers why they should buy from one business over another. To determine what a business’s USP is, competitor research is vital. One way to achieve this is to undertake a Points Of Difference (POD) and Points Of Parity (POP) exercise. This helps owners view how they are unique, as well as where their competitors are superior.

Identify Growth Trends

A competitor analysis can extend beyond looking at individual competitors and consider all businesses in the industry as a group. This allows owners to see trends occurring across the wider industry. For example, when looking at a group of businesses, there may be trends of companies achieving higher net profit margins. This may mean the industry is becoming more productive and efficient. On the alternative side, there may be trends showing an increase in cost of goods, resulting in lower profit margins.

By knowing trends that are impacting all/majority of businesses in the industry, owners can stay ahead of threats and make decisions to drive growth.

Discover Strengths & Weaknesses

A SWOT analysis identifies a business’s strengths, weaknesses, opportunities, and threats. The competitor analysis can uncover where the business is performing well against competitors and where they need to improve. This can be achieved via benchmarking performance metrics as well as undertaking industry research.

Build An Achievable Business Strategy

Building a strategic plan can be daunting for business owners. Therefore, a good place to start is by looking at what other businesses are achieving. This can help owners build realistic SMART Business Objectives and associated strategies. Reviewing competitors can also support owners figure out what they don’t want to do. This creates a stronger focus and builds a more robust business strategy.

Prepare A Winning Information Memorandum

When attracting investors for a new or growing business, one of the key areas they will want to know is ‘who are your main competitors.’ A competitor analysis is also vital when preparing an Information Memorandum (IM) to sell a business. Investors will want to see you have considered the current market and you have established a unique selling point.

How to conduct a competitor analysis for small to medium businesses

There are many academic methodologies you can use to conduct a competitor analysis. For small to medium businesses, we recommend breaking it down into three categories:

Direct competitors

Direct competitors should be a list of 6-10 companies that are extremely similar to the owner’s business. This means the same industry, similar location (or sales channel), similar products/services, similar size, and similar brand offering. The purpose of analysing direct competitors is to determine the company’s unique selling point.

The easiest way to find direct competitors is by a simple google search! Using the map feature you can search for other businesses like yours near your location. A google search can also show competitor google rating which gives a great reflection of how popular the business may be.

Tools to analyse direct competitors

See below three tools that can used as part of a direct competitor analysis for small to medium businesses.

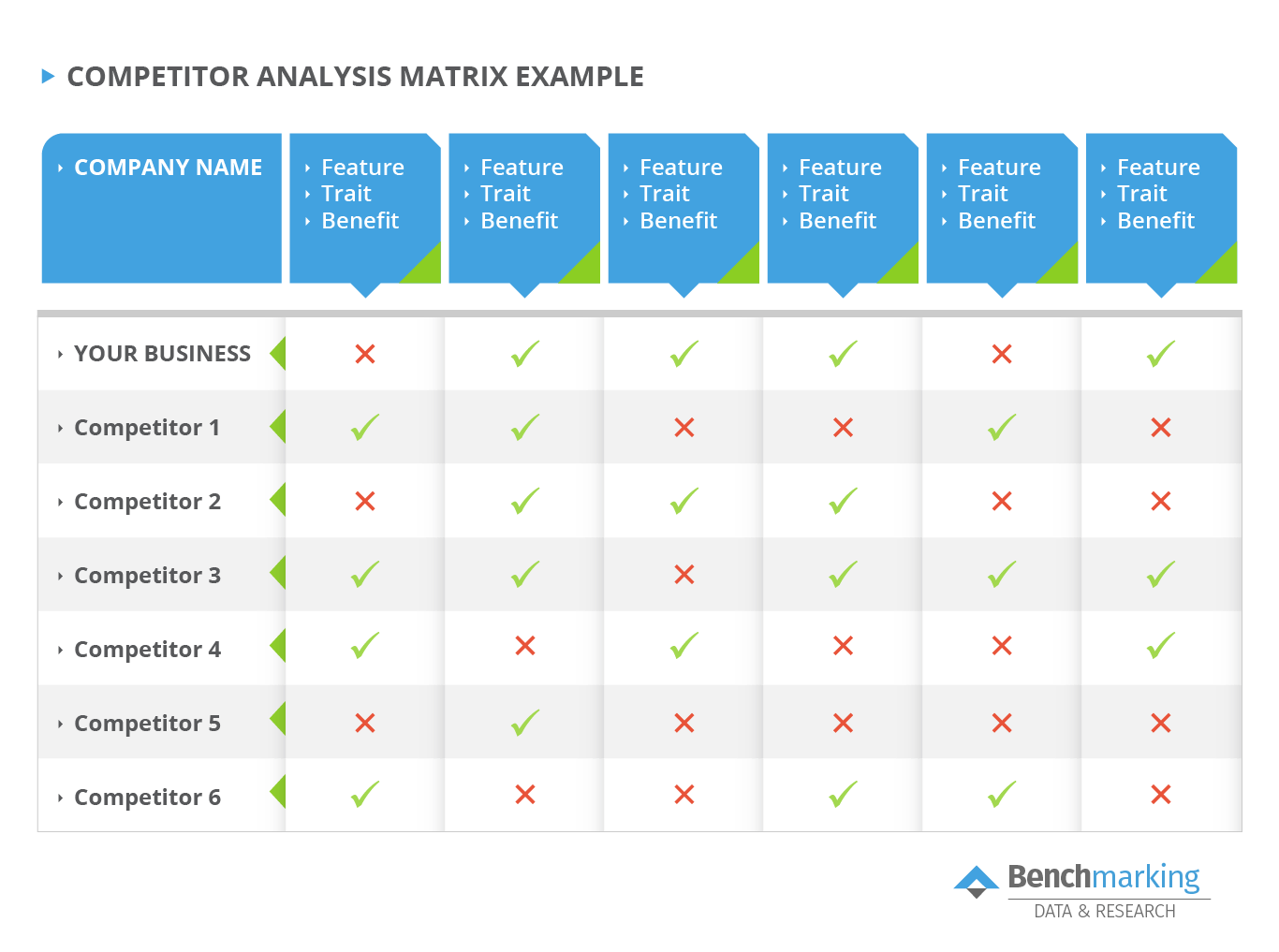

Competitor analysis matrix

The competitor analysis matrix is used to compare a business’s features and products against its main rivals. It is also important that the exercise is done for the owner’s business too.

For this model, the features/traits/benefits should include key selling points i.e. why someone would buy from that business. For example, for a café it may include: pre-order app, outdoor dining, licensed venue, kids play area, etc. it should not include ‘standard’ product offerings such as: coffee, breakfast served etc.

You can also include a google rating in this matrix if this is relevant to the industry.

Competitor Analysis Matrix Example

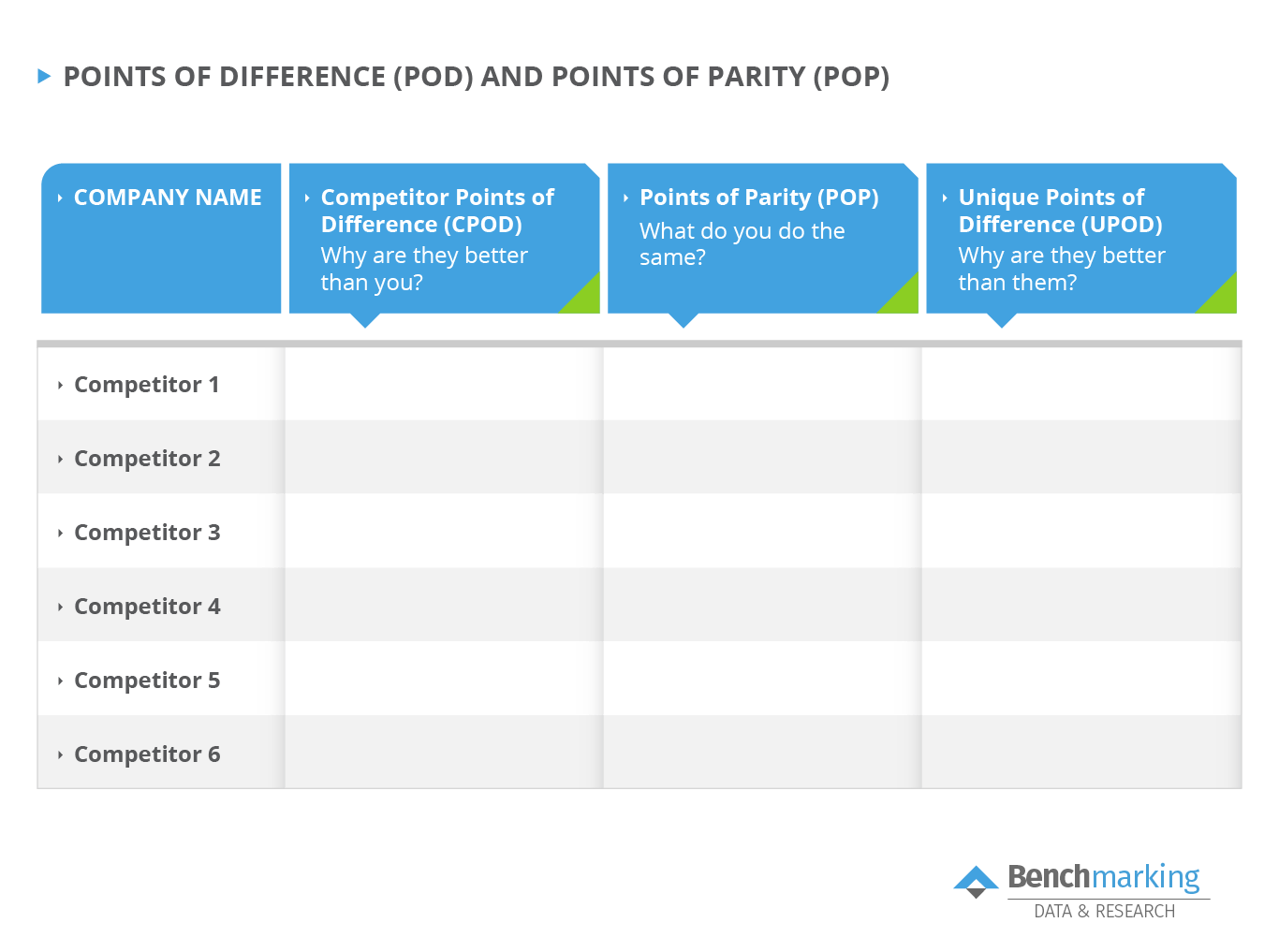

Points of Difference (POD) and Points of Parity (POP)

When reviewing competitors, one of the key findings should be the points of parity. This means, what does the owners business do the same as their competitors. There is nothing wrong with having points of parity, but these are not a unique selling point. You can use the table below to determine the business’s PODs and POPs.

Points of Difference (POD) and Points of Parity (POP) Table Example

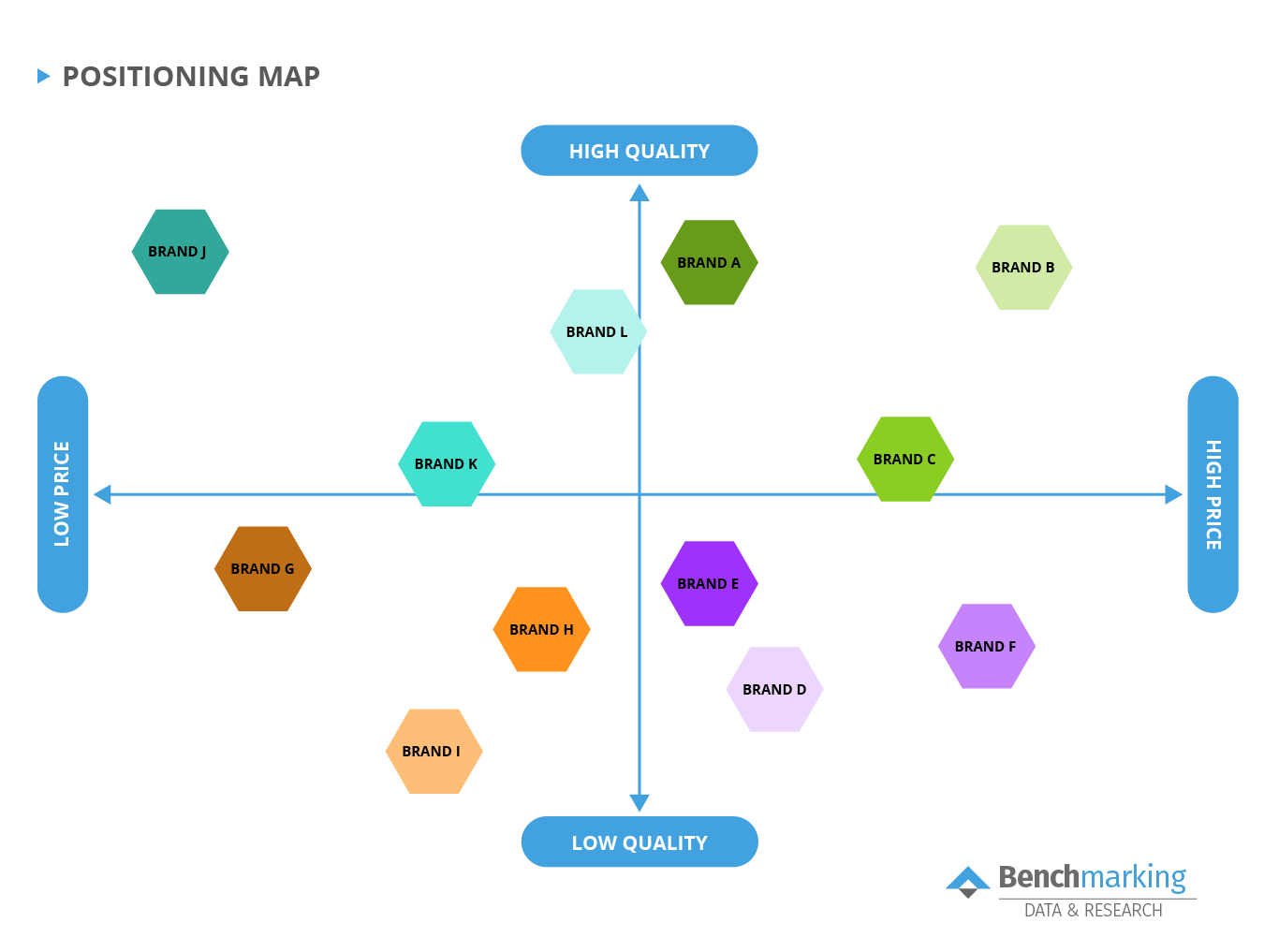

Positioning Map

The positioning map is a great visual tool to include in a presentation. The two axis can represent any factor, but often they are related to price and quality. Other measurements may include: speed of service, reputation and google ratings. Owners can also measure industry specific metrics such as healthy choices, variety of options, great taste etc.

The key is to see where the owner’s business fits on this map. It should also highlight if there are any gaps on the map to fill. For example, there may be a lot of businesses offering cheap services, but low quality – opening a gap for a higher priced high-quality offering.

Positioning Map Example

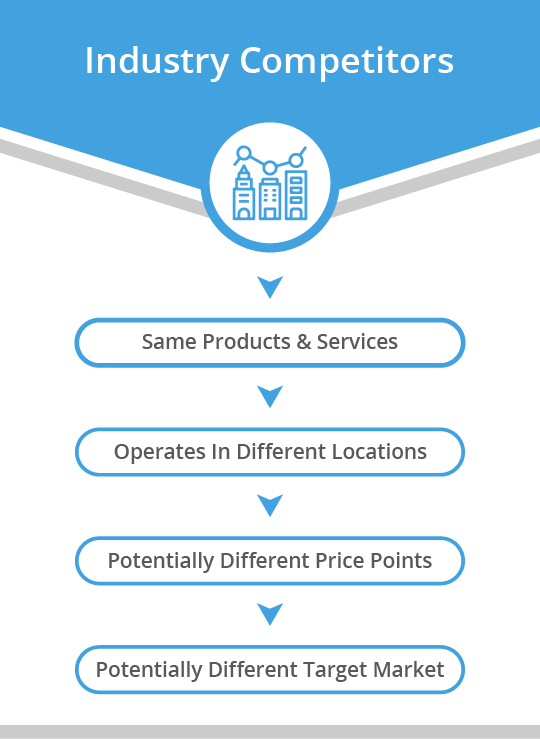

Industry competitors

Industry competitors are essentially all the other businesses in the industry. For example, a café owner may have 10 direct competitors in the same suburb. However, it is also worth the owner reviewing insights across the other 25,000 cafes in Australia.

When looking at the direct competitors, it is unlikely an owner will know their financial position. However, this information can be obtained on a group level. Therefore, when analysing industry competitors, the focus should be on comparing financial performance, productivity and industry trends.

How to analyse industry competitors

Read on to see how to analyse industry competitors. Or, click through here to read more about our industry reports.

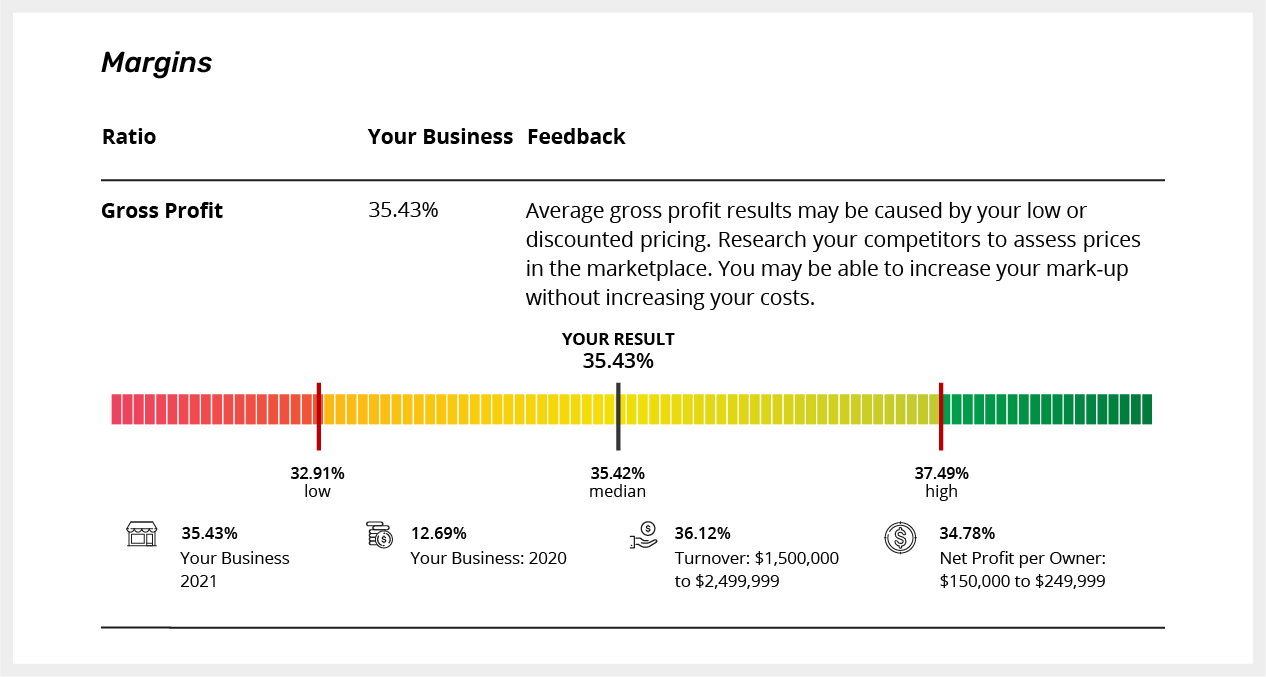

Financial Performance Comparison

When comparing an owner’s business against industry financials, it’s important to focus more on margins rather than dollar figures. For example, it’s more beneficial to analyse the net profit margin, not the net profit dollar figure. It is also important to choose metrics relevant to the chosen industry.

An easy way to showcase the results is via a benchmark. You can indicate high, medium and low numbers to show where the owner’s business fits on the scale.

This data can be difficult to come across as most businesses don’t openly share their financial performance! This is where tools such as the Benchmarking Suite can help. The Benchmarking Suite gathers financial data from thousands of Australian businesses each year to generate industry benchmarks.

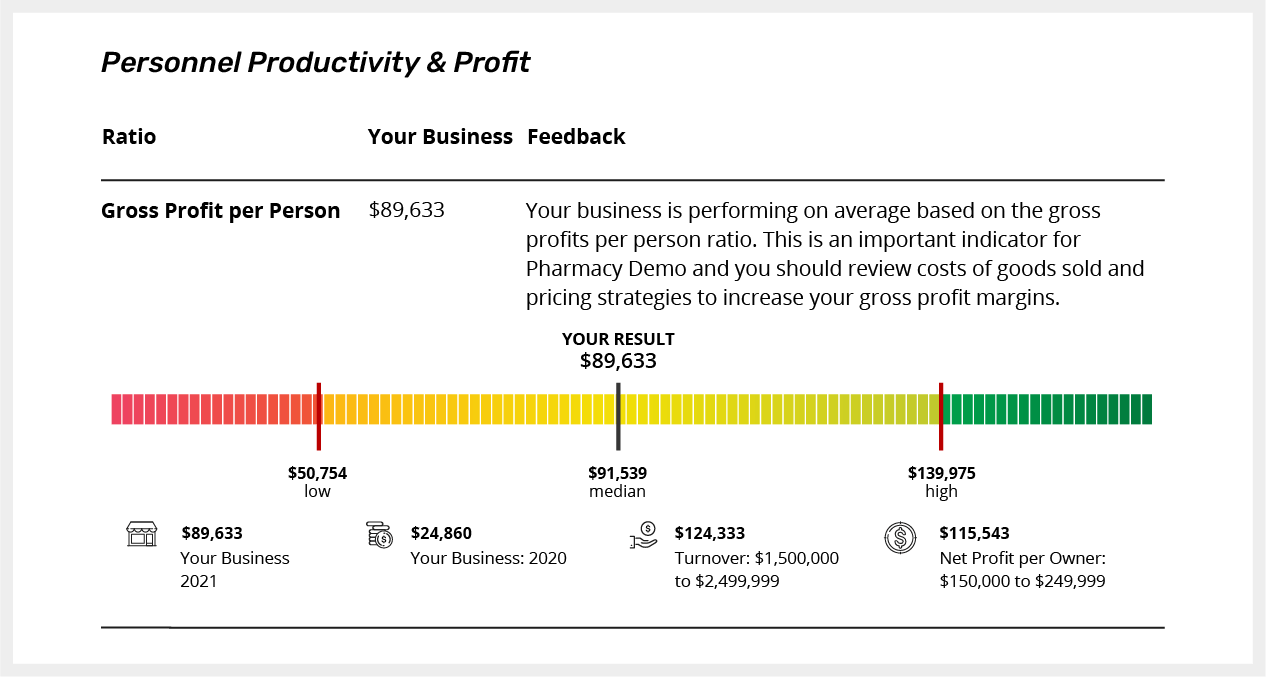

Productivity Benchmarks

One of the most important competitor comparisons is productivity. This may be employee productivity or asset efficiency. Improving productivity should be a constant focus for business owners as it can improve the bottom line without having to hire more people or purchase additional assets.

Like financial results, finding productivity results can be difficult and it requires knowing financial information, employee numbers and asset value.

However, this information is sourced as part of our Benchmarking Suite. Owners can also research industry associations and gather high level data from the ATO.

Industry Trends

Industry trends can be included in the competitor analysis, or as a separate section. Industry trends should be the largest factors impacting all businesses in the industry. When reviewing this from a competitive view, owners can assess how their peers are reacting to trends to determine what they should do.

For example, the industry may be going through a skill shortage. Therefore, owners should look at how others are recruiting and retaining employees.

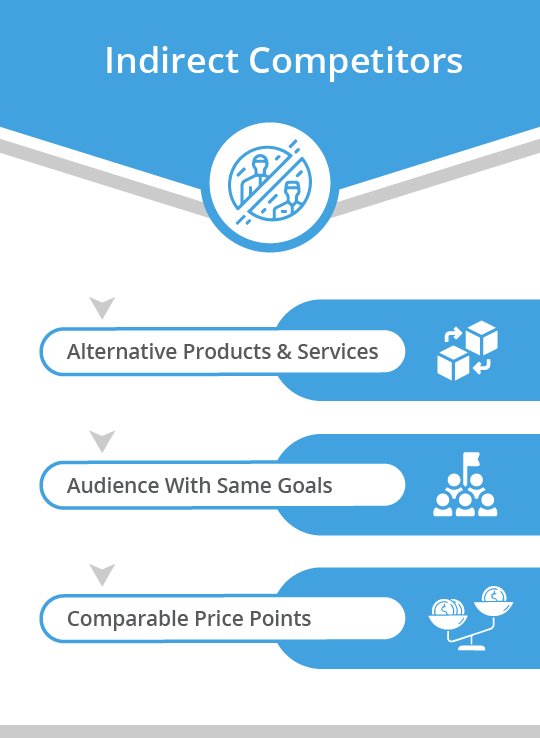

Indirect competitors

Indirect competitors are an important part of the competitor analysis – but often omitted. An indirect competitor is a business that offers different products and/or services but competes for the same market. They also solve the same (or similar) problem for the customer.

For example, someone may decide between a gym membership or buying an exercise bike. Or between hiring a carpenter or buying tools and wood from the hardware store.

The characteristics of indirect competitors include:

• Solving a similar problem for the market

• Similar price points

• Similar ease of purchase

For indirect competitors, it can be beneficial to also conduct a POD and POP on an industry level to ensure a strong USP.

You’ve done a competitor analysis – now what?

Once complete, the competitor analysis should be used to inform the business strategy and support owner to set SMART Objectives.

Ideally, a competitor analysis should be done annually to look at what is happening in the industry and how the business is performing.

If you’re undertaking a competitor analysis for your client/s, why not test out our Benchmarking Suite for free? Click through below for more details.