The Value of the Business Value – are you short-changing your clients?

- Home

- Articles

- Insights & trends

- The Value of the Business Value - are you short-changing your clients?

81% of Small the Medium Enterprise (SME) owners in Australia have no succession plan or retirement plan in place.[i]

And why would they?

The reality is, many SME owners don’t think about their long-term plans. Of this 81%, 54% said they have either never considered a plan or are not exiting any time soon. And a further 30% said their business is not complex enough to need one.[ii]

SMEs are focused on urgent issues

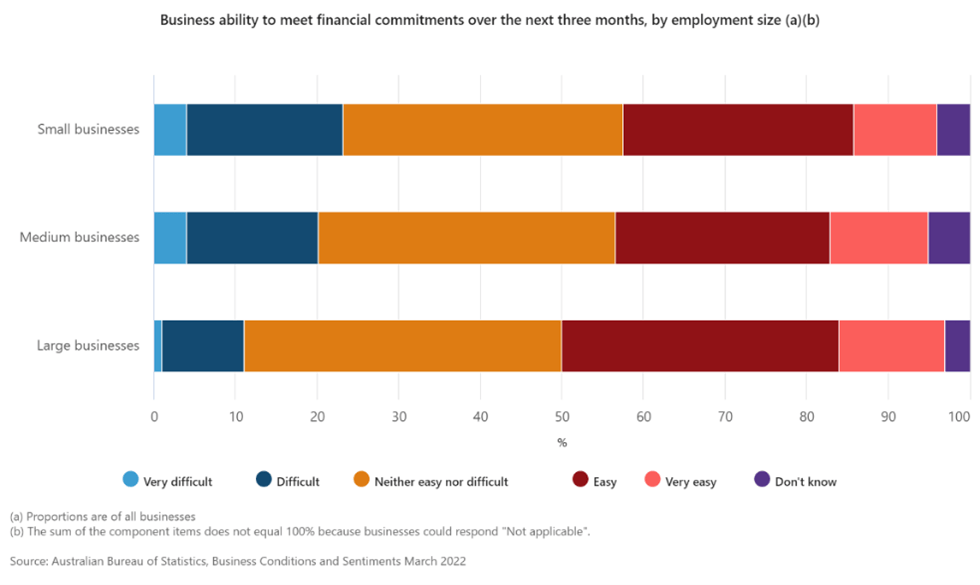

According to the ABS, in March 2022, less than half of small and medium Australian businesses found it ‘easy’ to meet their financial commitments over the next 3 months.

So, it may seem counterintuitive to discuss the business value and long-term plans with clients who are just trying to stay afloat week to week.

But the impact of business owners not focusing on their long-term plans can be devastating.

So how many businesses are sold in Australia?

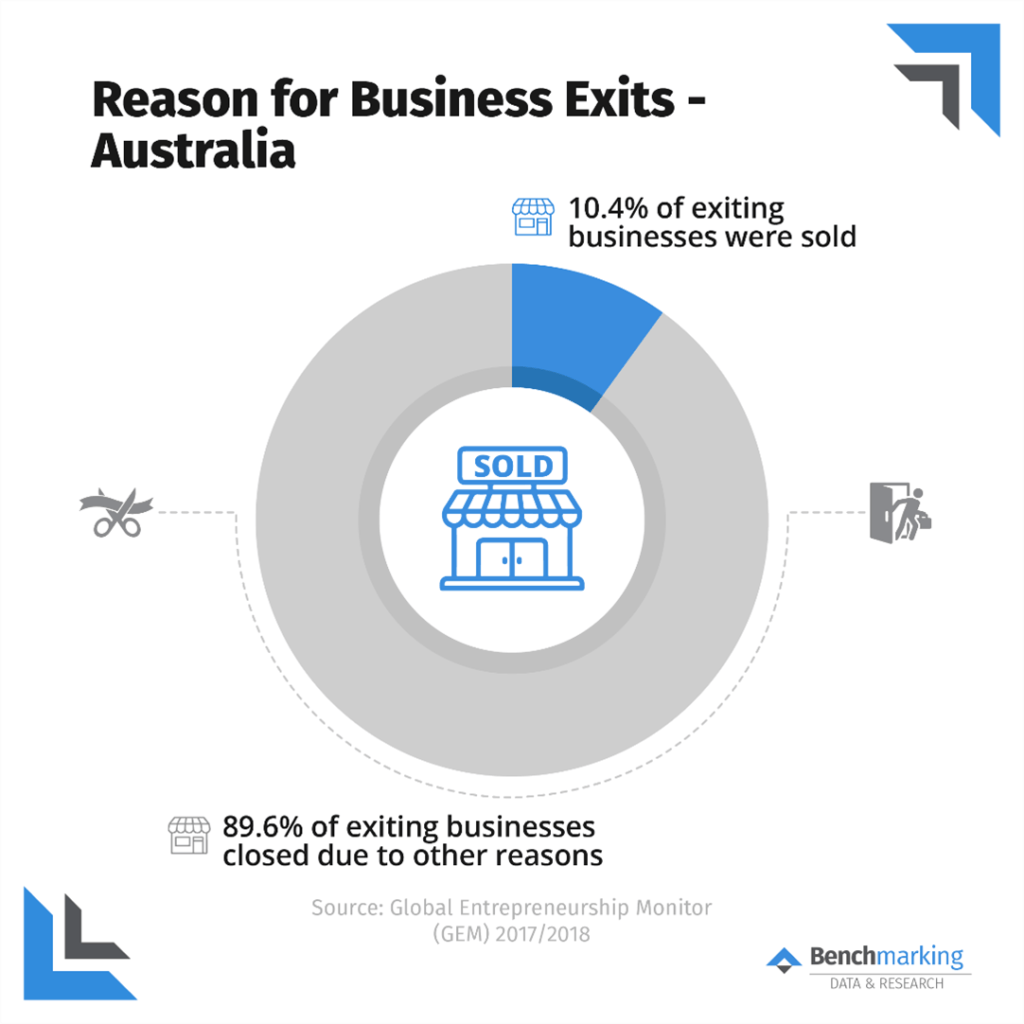

In Australia, it’s estimated that 62% of family business owners plan to sell or transfer their business and just 2% want to close the business with no sale or transfer.[iii]

However, research shows that only 10.4% of exiting businesses are successfully sold.[iv] 32% of businesses exit because they are unprofitable and 17.1% close due to personal reasons.[v]

The key reason for the discrepancy between desired exit and reality is the exit strategy. 75% of business owners believe it only takes a year, or less, to prepare and sell a business. And 58% have never had a formal business value appraisal.[vi]

Further investigations suggest that the first-time businesses have an appraisal is when they are looking to sell or retire. This is when the issues arise.

A poor business value result combined with a need to exit the business leads to business owners:

a) Selling a business for much less than they wanted to

b) Working for longer than they intended

c) Settling for a sale of assets only

d) Closing the business completely without any remuneration

The heavy impact on business owners

The core issue for business owners is that many of them rely on the sale of their business for their retirement planning. Self-employed Australians have approximately half the amount of super as their employed counterparts.[vii]

“Around 20 per cent of the self-employed have no superannuation, compared with only 8 per cent of employees. Many of the self-employed who have some superannuation would have accumulated their balances when they were an employee at some stage in their working career.”[viii]

This results in business owners being left high and dry in retirement after years of hard work.

Whilst the statistics are sombre, there is a solution. And, as a business consultant or accountant, you’re in the unique position to support business owners to reach their desired end goal.

Consultants – time to step up!

The research is clear. Business owners are NOT going to think about their long-term plans, or business value, until it becomes urgent or an immediate task. Therefore, as a consultant, you need to do this for them.

A conversation today with your clients could be life-changing for their future.

We have listed 5 things you can do right now, to ensure your clients are not short-changed in the future.

1. START THE CONVERSATION

The most important step is to start the conversation with your clients about how they plan to exit their business. Whilst they may have never thought about it, and may not have an answer, planting the seed early will result in future benefits. A lot of business owners may be unaware of their options, so it is important to do your research prior regarding possible exit strategies.

The aim of this conversation is NOT to determine a plan straight away but to understand what your client’s intentions are.

2. RUN A BUSINESS VALUATION ANALYSIS

As stated above, only 2% of family business owners plan to close their business. Thus, the remaining 98% will require a business valuation at some stage in order to sell or transfer the business. Unfortunately, this often occurs far too late in the process.

We recommend a business value review is undertaken annually so owners know where they stand. Further, by knowing a valuation at least 3-5 years prior to selling a business, business owners can make strategic decisions to determine if the figure meets their expectations. If it doesn’t, they can enact a plan to increase the business value and make the entity more attractive to potential buyers.

3. DISCUSS THE EXIT OPTIONS

An exit strategy does not have to be a fixed plan if the business is a long way from exiting. It is sometimes more beneficial for business owners to explore a range of exit options at the start of the process.

By reviewing all the potential options, and understanding a client’s position, you are giving them options and choices so they can be in control of their exit when it comes.

However, a decision should be made a minimum of 2-3 years out from exiting so the business can prepare.

4. PLAN TO MAXIMISE BUSINESS VALUE

All exit strategies will benefit from an increased business value. But, increasing the value will take years to come to fruition. Thus, it is important to start planning early. The more time a business can focus on increasing its value and salability, the more attractive it will be to potential buyers.

You can use tools such as our Business Valuation Analysis to determine how much a business value would increase – or decrease – if your client implemented different investment decisions. By knowing where and how to invest, you can confidently build long-term plans for your clients.

5. AGREE ON MONITORING AND TRACKING

Whilst Profit & Loss results are often reviewed monthly, business value can be left out of the picture altogether. We recommend reviewing the business value annually to ensure the results are on track for the desired long-term plan.

Getting client buy-in on an annual review of the business value will greatly increase their chance of a successful business exit. As stated above, 58% of businesses have never had a business valued, so running these on a regular basis gives your client a competitive advantage.

The key takeaway

Starting a conversation today could prevent your client/s from being short-changed in 5,10 or 20 years. By opening up the conversation, you are positioning them to be in control of their business exit. You are giving them options and setting up realistic expectations. And, you are giving them time to prepare.

It’s never too early to discuss an exit strategy with your client – but it could be too late.

Sign up for a FREE TRIAL today and run a business valuation for one of your clients.