The Legal Services industry is, by nature, competitive. In many cases, firms thrive or fail pending their ability to outplay the competition. Yet in Australia, the balance of supply and demand for legal services over the past 10 years has been relatively balanced; arguably slightly in favour of the law firms themselves.

This ‘balance’ has enabled the Legal Services industry to largely set the agenda for pricing and conditions. Therefore, competition has been focused on winning in the courtroom and not the business boardroom.

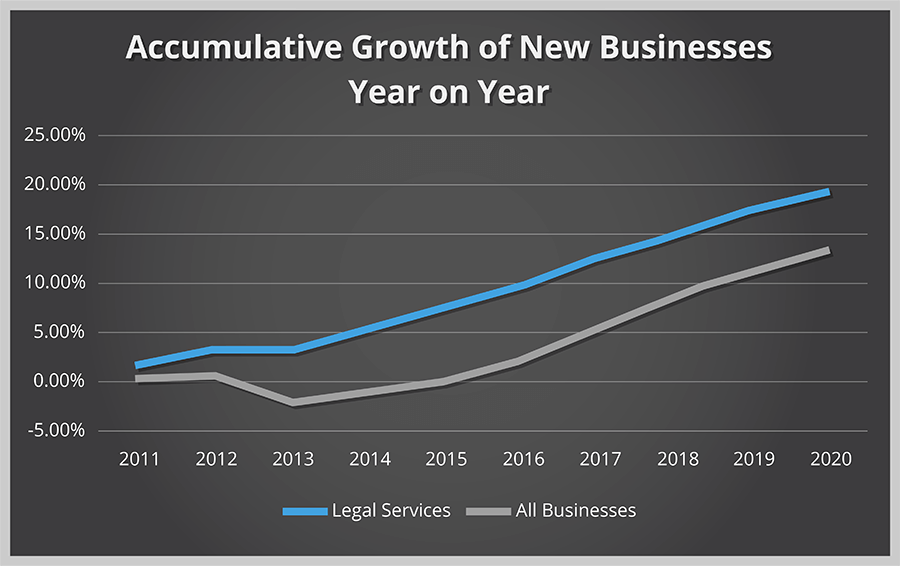

According to the latest statistics from the ABS, there 22,337 Legal Services firms in Australia and this number has grown by 18.9% over the past 10 years. A growth rate 39% higher than that of all Australian businesses over the same period at 13.6%.

Source: ABS Counts of Australian Businesses

As new firms continue to enter the market, and saturation approaches, Legal Services firms are slowly, but surely, seeing a decline in power.

The shifting balance & rising power of the client

“Clients—not lawyers—are now calling the shots and driving the transformation of the legal industry. Lawyers long controlled the delivery of legal services because legal expertise was its sole ingredient. Those days are gone—both for lawyers as well as allied legal professionals who, with machines, are now integral components of the legal workforce and supply chain. Legal delivery has morphed into a three-legged stool supported by legal, technological, and business expertise.”[1]

Mark A. Cohen – Legal Moasic

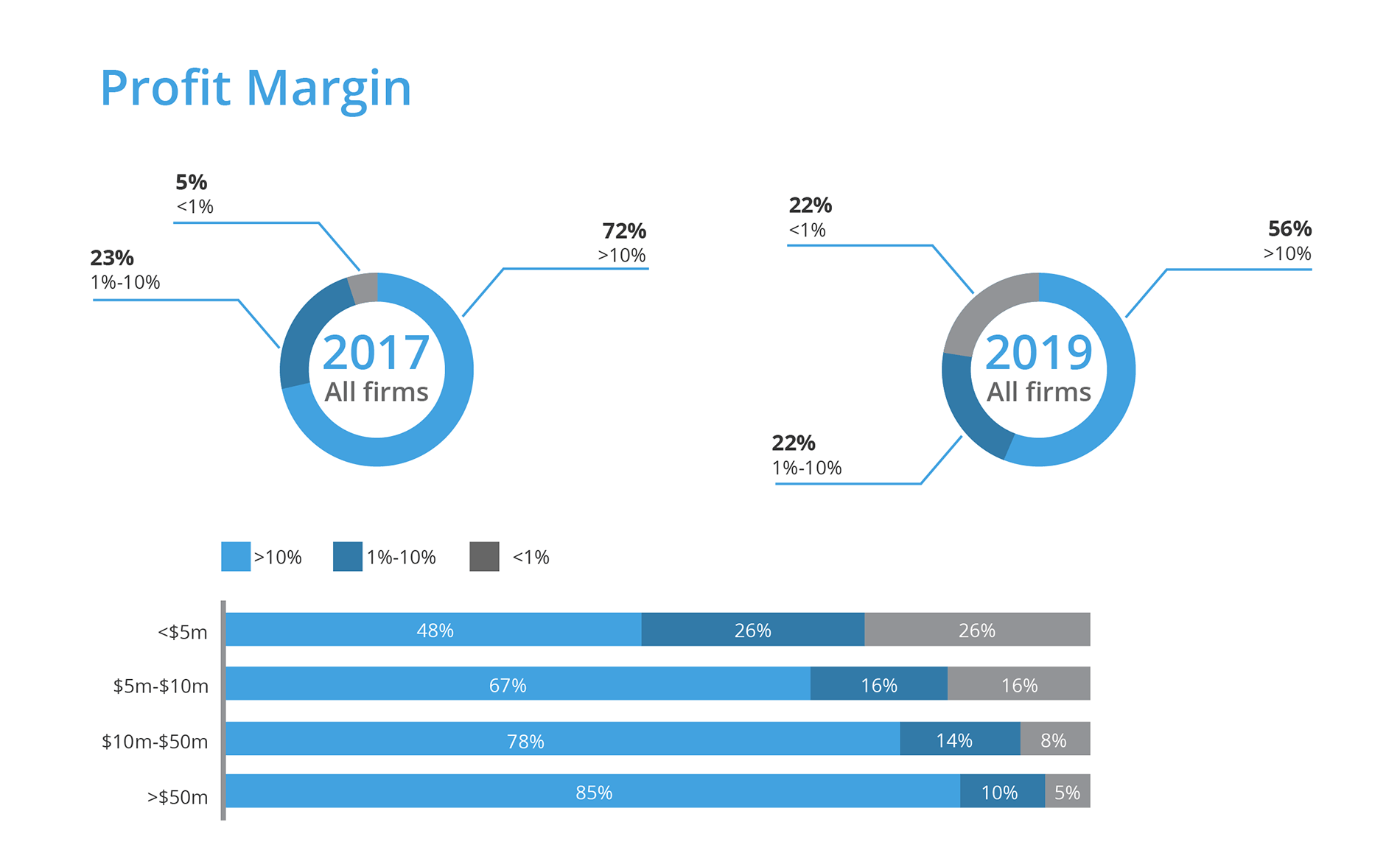

Pre COVID-19, the Legal Services industry was experiencing a shift market conditions. In 2019, 22% of firms achieved less than a 1% profit margin, growing from only 5% in 2017.

Source: 2020 Macquarie Business Banking | Legal Industry Pulse Check Report

The beginning of the profit decline can be tied to the shifting balance of power between firms and their clients. In a 2019 survey, legal services firms stated they were under continued pricing pressure from clients, with 70% of firms stating they were under pressure to deliver value and solve problems, not bill time.[2]

In addition to the number of firms growing in the market and the downward pressure of clients, the industry also began to face new threats including:

- Entry of the ‘Big 4’ Accounting Firms: who over the last decade have quietly rebuilt their legal networks, integrating these services into a new model of “globally integrated business solutions,”[3]

- Increase in substitute suppliers: with the emergence of alternative legal service providers, clients can seek legal advice from a wide range of other professionals like paralegal technicians, legal document preparers, and self-help sites.[4]

- Ease of access to offshore virtual assistants and Legal Process Outsourcing (LPO’s): both firms and clients have taken advantage of offshoring following the global trend in bringing in LPOs for better cost efficiency and productivity. [5]

The COVID-19 Impact on Legal Firms

As a slight downward shift was already occurring when COVID-19 hit, it was forecast the Legal Services Industry in Australia would experience a sharp decline due to the pandemic, resulting in a decline in 3% over the next 5 years[6]. However, as demand in the legal market contracted by 5.9% in the United States (during the COVID-19 pandemic) over the same period, that demand grew in Australia by an average of 6.2%.[7]

So what happened?

In short: demand increased substantially for Legal Services due to the pandemic.

“When the pandemic hit Australia, governments moved quickly to introduce new rules and regulations to help businesses withstand the financial impact. The temporary changes spanned continuous disclosures and financial reporting obligations through to laws covering insolvency, capital raisings, rent relief and moratoriums, and the workplace. Legal firms were indispensable advisers, helping businesses navigate the changes and understand how to best apply them.”[8]

Whilst demand is high and outweighs supply, clients are at the mercy of the supplier. However, as Australia emerges from COVID-19 restrictions and the economy recovers, it is forecast the Legal Services industry will transition back to its previous trajectory; with the client holding the balance of power.

This sentiment is highlighted by the fact 64% of firms expect downward pressures on fees will accelerate due to COVID-19 and clients will be expecting far more for less.[9] Research also shows that the market is anticipated to become saturated as more external players start offering legal services, which will increase price pressures and constrain revenue growth. [10]

However, COVID-19 has also resulted in 71% of mid-size legal firms expecting to innovative and adopt new forms of technology, 76% believing remote working will play a much larger role in the legal profession and 50% of firms stating they will expand the use of existing technology to improve legal work processes.[11]

“Undoubtedly the overall impact of COVID-19 has accelerated new thinking and innovation”[12]

Time to shift the competition to the boardroom

So where to from here?

Whilst the industry may continue to benefit from the legal services required due to the pandemic in the short term, COVID-19 has in-fact masked the inevitable transition in power taking place across the industry.

It is therefore an opportune time for Legal Services firms to shift the competition ground from the courtroom to the boardroom and focus on business strategy. The Benchmarking Group has listed three key strategies Legal Services firms can consider to be competitive post the ‘pandemic-boom.’

1. Know your strengths and your opportunities

Though there are many ways to organise and manage a successful law firm, those that have the courage to do a holistic re-assessment of their capabilities stand the best chance of surviving and thriving in the uncertain future that awaits us all. [13]

Understand how well your firm is performing and establishing realistic business goals is the first step to gaining a competitive advantage. Tools such as www.benchmarking.com.au gives firm owners in depth insight into how their business compares to the competition. For example, are your profit margins higher or lower than the industry average? Are the owner earnings comparable? And should you be investing more in business expenses? These benchmarks enable business owners to build focused strategies on areas which are under performing and maintain strategies for areas that are highly positive.

In addition, a report such as the Business Benchmark Report, can provide business valuation details as well as profit gap analysis to determine what you should do to increase the value of your Legal Services firm.

2. Invest in technology to increase productivity and drive business improvements

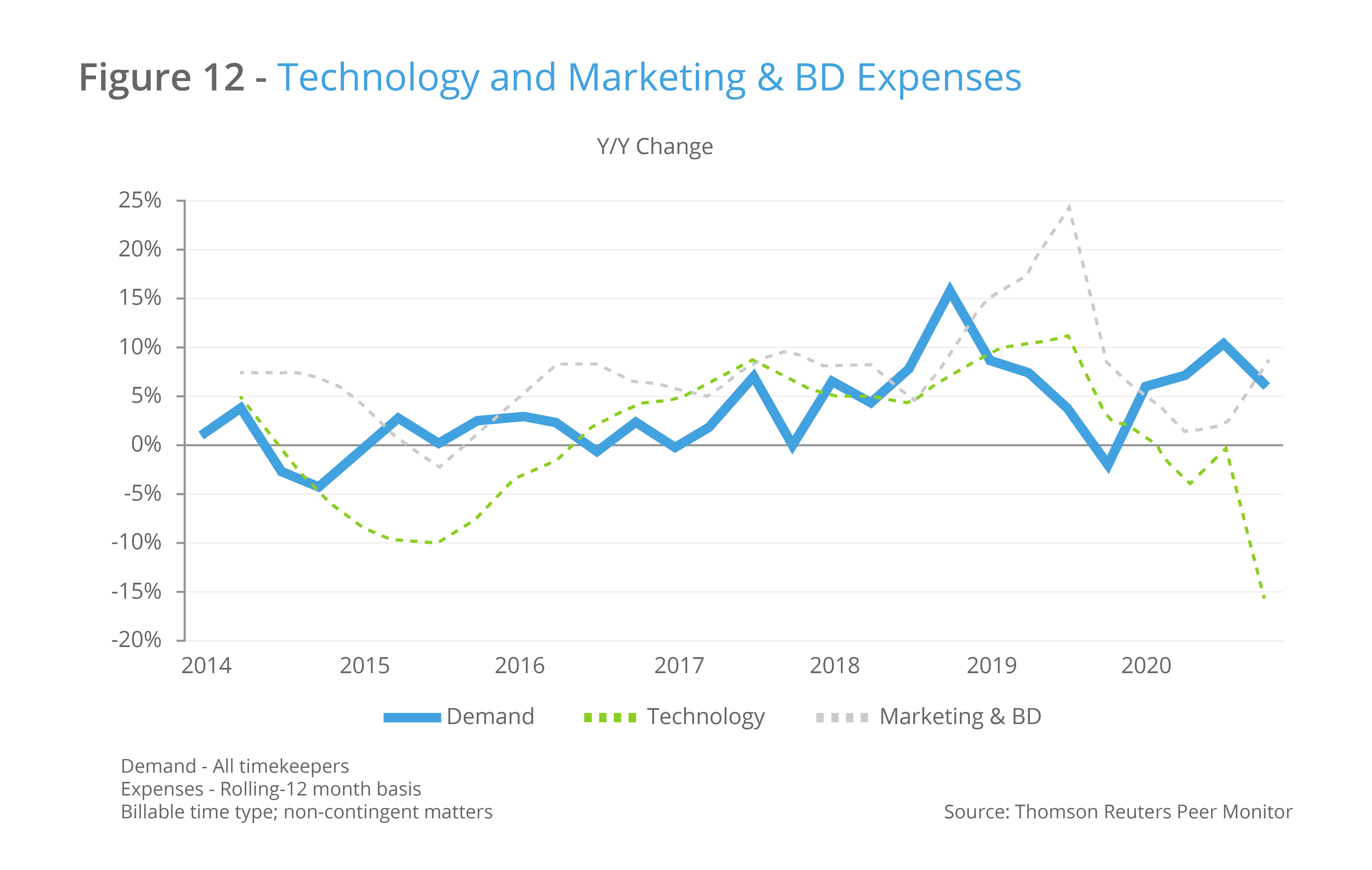

Technology use is rapidly expanding across all industries, and the Legal Services industry is no exception. With a large percentage of Australians forced to work from home at some stage in 2020 (and many still in 2021) firms were forced into investing in new technologies. As stated in a recent report:

The pandemic has fast-tracked technology procurement decisions at some firms, and those that had already invested in a robust virtual working environment have benefited tremendously during the pandemic. This trend is reflected in the emphasis on technology expenditures over marketing and business development in 2020.[14]

Yet despite the requirement for investment due to remote working, firms can proactively look to technology to drive productivity. In fact, business analysts McKinsey predicting that up to 23% of lawyers’ time can be automated by 2025.[15]

Research shows that Australian lawyers are wanting investment in technology, with two thirds of lawyers interviewed wanting to see an increased investment in technology by their firms.[16]

Firms that leverage new innovations will not only be primed for improved productivity, but also be positioned for rapid change in the event of future pandemic related restrictions.

3. Focus on value-added services for clients

It’s a time of change for the legal industry, but law firms who continue to improve their understanding of clients and provide a holistic legal service will rise to the top[17]

Legal Services firms have always been client focused; however, clients are now increasing their demands on firms to remain a loyal customer. For many firms, client retention is also about client education and improving transparency. Thus, the emphasis is on selling a great client experience and legal expertise, rather than simply knowledge.[18]

Adding value for clients can include revisiting billing arrangement and shifting from per hour costs to project/issue-based services.

The shift in client power has already began and arguably firms that take a proactive approach to understanding their client’s needs and add non-monetary value may ironically end up with a strong profit position than those who focus solely on time-based legal billing.

In the end – who wins?

Key client retention is the battleground in a highly competitive environment.[19]

In the end, the firm that can win new clients and retain current clients, will win battle of the 22,337 firms. However, with innovations in new technologies, new entrants and substitutes and a saturated marketplace, Legal Services business owners cannot simply rely only on winning the case in the courtroom to drive business growth. Competition will continue to increase, and the firms that balance legal services performance with a focused business strategy, will be best placed on the proverbial high ground.

[1] https://www.forbes.com/sites/markcohen1/2019/10/07/big-money-is-betting-on-legal-industry-transformation/?sh=7e6a66f75ce2

[2] https://www.macquarie.com.au/assets/bfs/documents/business-banking/bb-legal-industry/2020-macquarie-business-banking-legal-industry-pulse-check-report.pdf

[3] https://thepractice.law.harvard.edu/article/the-reemergence-of-the-big-four-in-law/

[4] https://www.findlaw.com.au/articles/6384/6-trends-shaping-the-legal-industry.aspx

[5] https://www.beroeinc.com/category-intelligence/legal-services-australia-market/

[6][i] https://www.quantumhouse.com.au/wp-content/uploads/2020/09/Industry-Performance-and-Outlook_Legal-Services-2021.pdf

[7] https://insight.thomsonreuters.com.au/legal/resources/resource/2020-australia-state-of-the-legal-market

[8] https://www.commbank.com.au/content/dam/commbank-assets/business/insights/docs/legal-market-pulse-nov-2020.pdf

[9] https://www.commbank.com.au/content/dam/commbank-assets/business/insights/docs/legal-market-pulse-nov-2020.pdf

[10] https://www.quantumhouse.com.au/wp-content/uploads/2020/09/Industry-Performance-and-Outlook_Legal-Services-2021.pdf

[11] https://www.practiceevolve.com/the-future-of-australias-legal-sector-following-the-global-covid-19-pandemic/

[12] https://www.practiceevolve.com/the-future-of-australias-legal-sector-following-the-global-covid-19-pandemic/

[13] http://images.connect.thomsonreuters.com.au/Web/TRLegalAU/%7B1efb4274-f484-4240-a272-cb7d882e6d2c%7D_2020_Australia_SOTLM_Final.pdf

[14] https://insight.thomsonreuters.com.au/legal/resources/resource/2020-australia-state-of-the-legal-market

[15] https://www.nytimes.com/2017/03/19/technology/lawyers-artificial-intelligence.html

[16] https://www.thomsonreuters.com/en-us/posts/legal/future-working-practices-report-2020-acritas/

[17] https://www.findlaw.com.au/articles/6384/6-trends-shaping-the-legal-industry.aspx

[18] https://www.findlaw.com.au/articles/6384/6-trends-shaping-the-legal-industry.aspx

[19] https://www.macquarie.com.au/assets/bfs/documents/business-banking/bb-legal-industry/2020-macquarie-business-banking-legal-industry-pulse-check-report.pdf